As we recently saw when we analyzed the Swiss Watch Industry Association report and its export data, the watch industry is not at its best; Exports are declining, sales of large corporations are declining and difficult times lie ahead for 2026. The outlook remains cautious as the industry is expected to continue to face headwinds from a strong Swiss franc, inflation and economic and political uncertainties. However, this does not seem to have any impact on a handful of brands and corporations, especially Rolex, which undoubtedly remains the undisputed market leader with sales of over CHF 10 billion. This is one of the many insights from the recent Vontobel report, but the analysis needs to be nuanced – especially when looking at the top 10 watch brands for 2025.

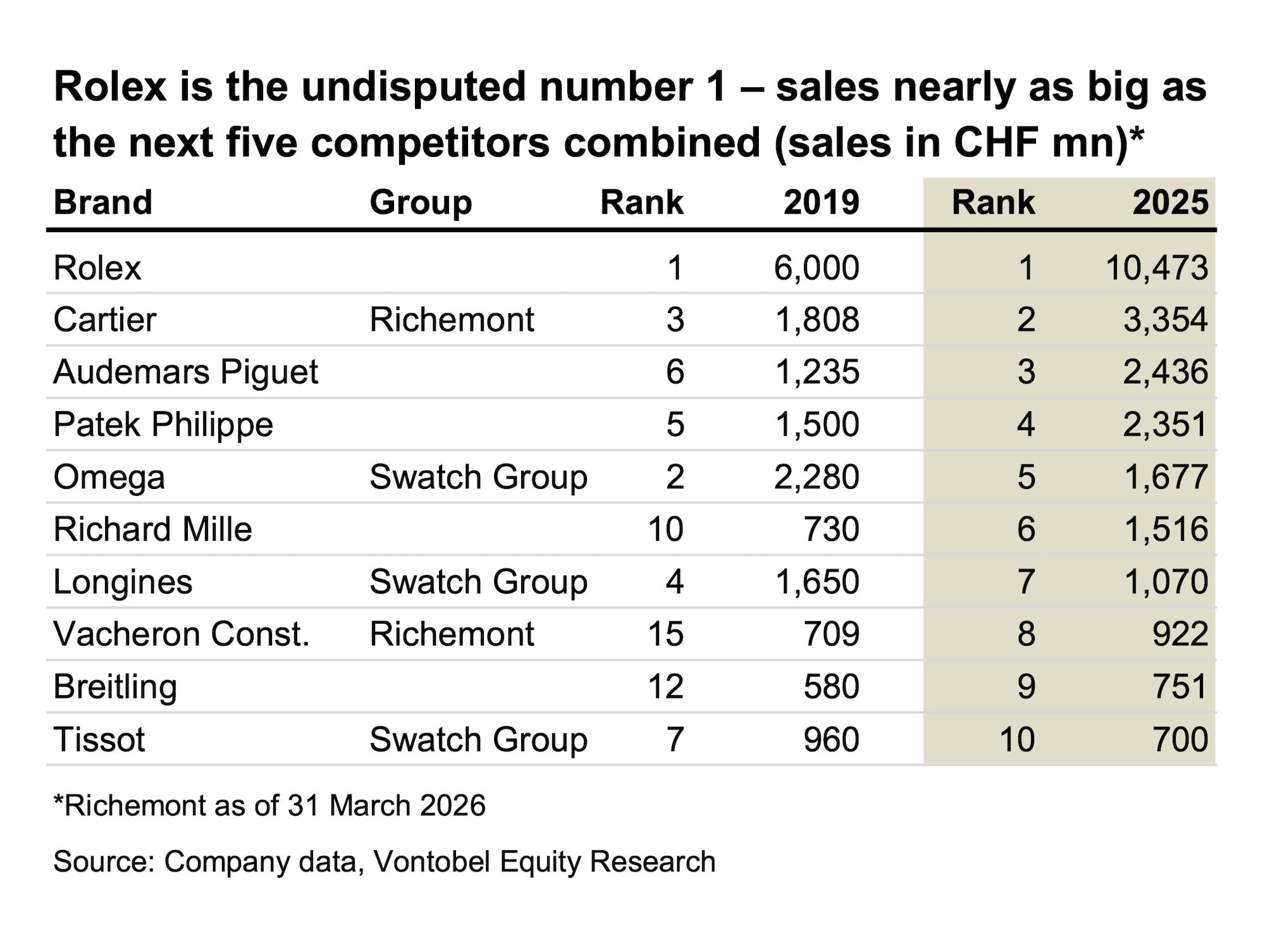

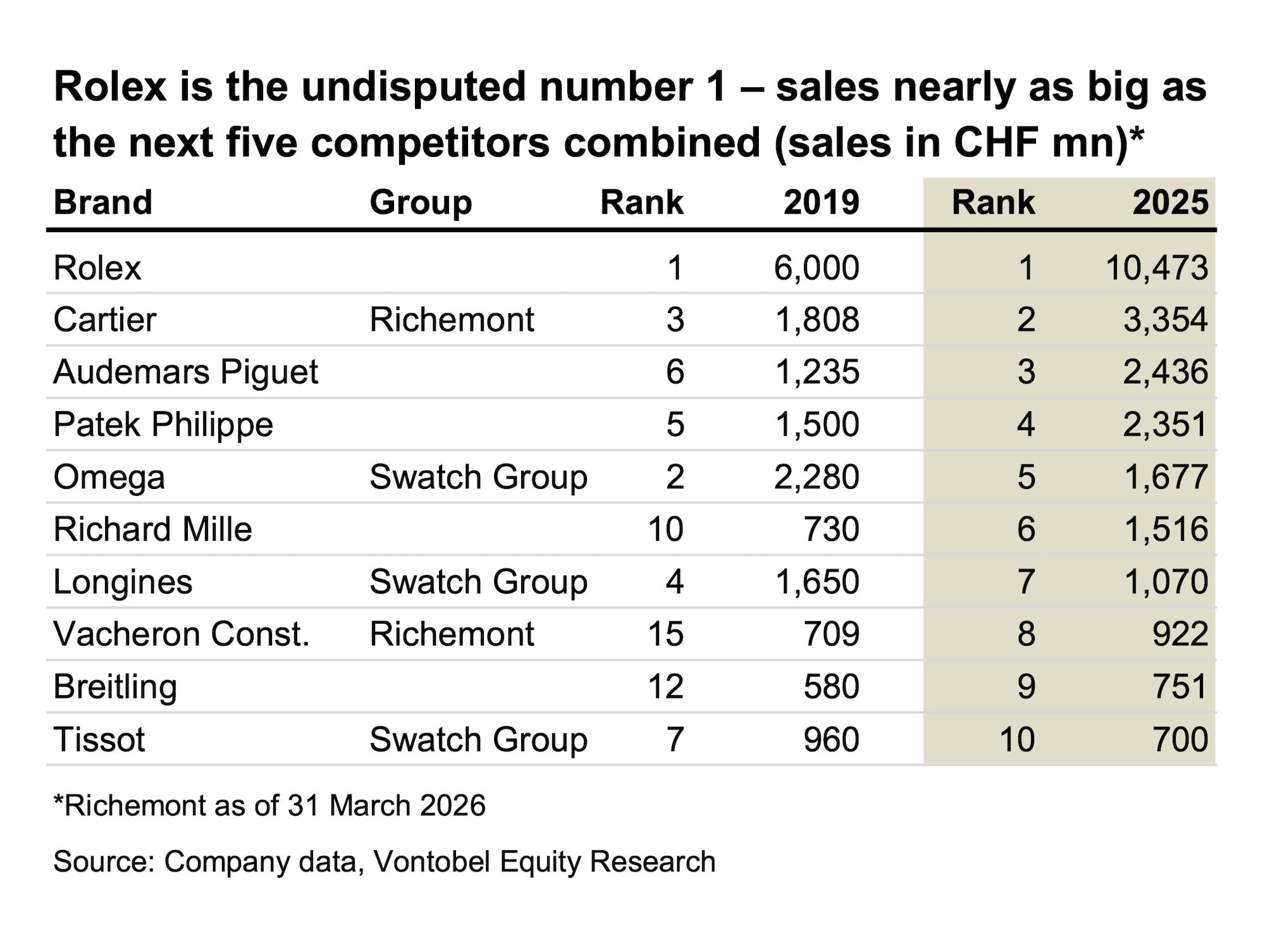

The Swiss bank Vontobel is one of the few organizations with real credibility in producing an annual report on the watch industry and luxury goods in general. Along with the report from Morgan Stanley and LuxeConsult, Vontobel's analysis is a must read. Led by Jean-Philippe Bertschy, Head of Swiss Equity Research at Vontobel, the latest report provides clear evidence of the current changes in the industry. The highlight, of course, remains the following graphic, which lists the ten best watch brands in 2025, according to Vontobel estimates (most of these brands do not publish their financial results).

Reproduced with permission from Vontobel

Reproduced with permission from Vontobel

Aside from Rolex's impressive sales, which still top 10 billion CHF, the most notable aspect of this graph is Rolex's relative size compared to its competitors. Rolex's sales are equal to the combined sales of the next five competitors. This shows that there is a real polarization of the industry, or that “the industry is becoming increasingly oligopolistic,” as Vontobel puts it. Almost all of them are positioned in the upper segment, with the exception of Tissot and Longines, which operate in the lower segment of the industry. As the report shows, the top ten brands in the “premium segment over CHF 500” now account for almost 70% of export volumes, while concentration in the segment over CHF 3,000 increases to over 80%, underscoring the systemic importance of a handful of dominant players to the watch supply chain.” In recent years, only a handful of brands have managed to maintain or increase their volume – unsurprisingly, these are large independents such as Patek Philippe, Audemars Piguet and Richard Mille, with Cartier also benefiting from strong momentum.

It is also worth noting that Vontobel's report indicates that an increasing share of Rolex's revenue comes from the Certified Pre-Owned program, which is now an important contributor and “will generate an estimated turnover of CHF 500 million in 2025”. Things have changed pretty drastically in the last decade. Vontobel adds: “In 2019, the Swatch Group was the largest watch company in terms of watch sales. Six years later, both the Rolex Group (including Tudor) and Richemont's watch sales exceeded those of the traditional bands, thanks to exceptional growth particularly at Rolex and Cartier.”

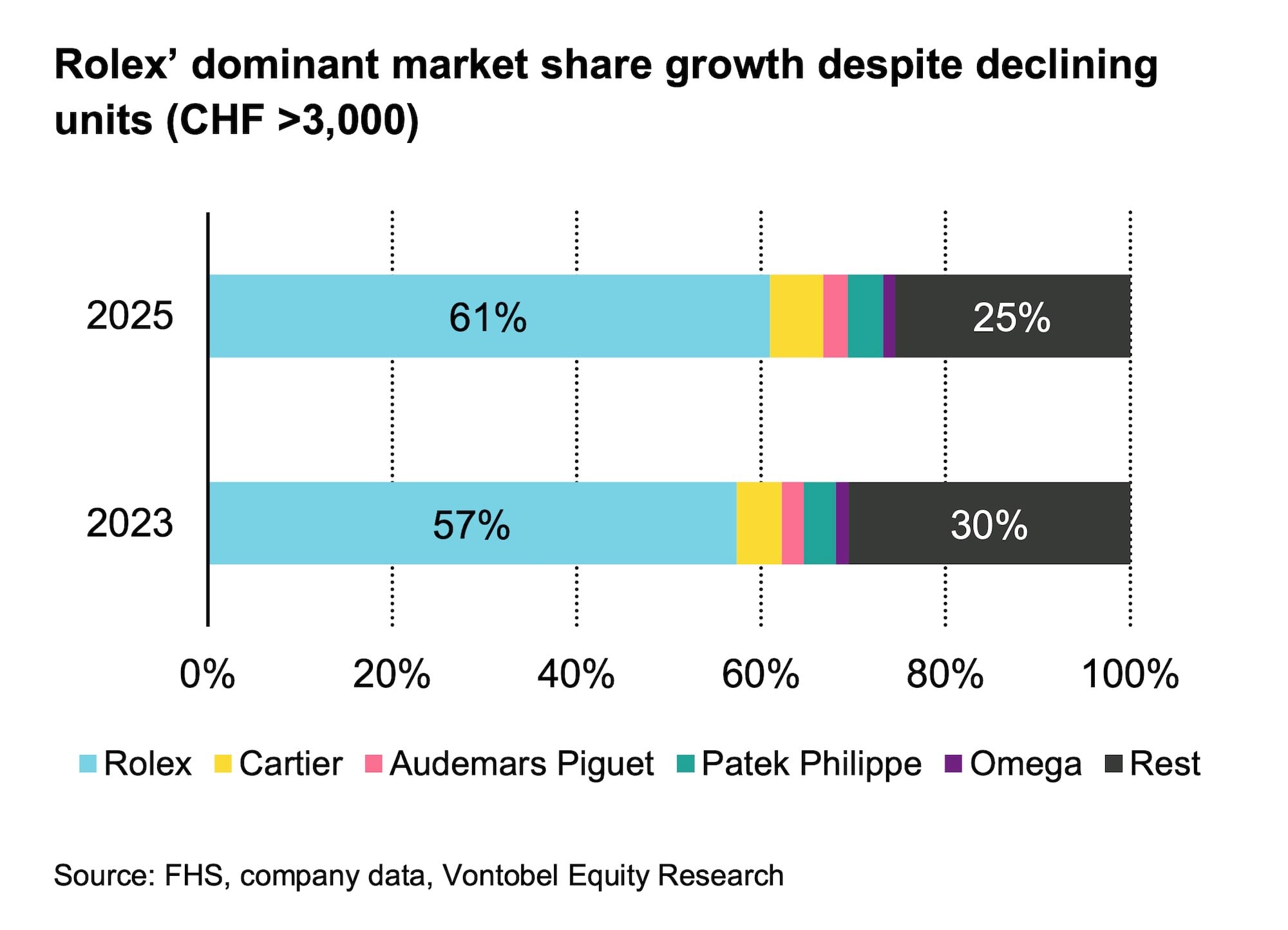

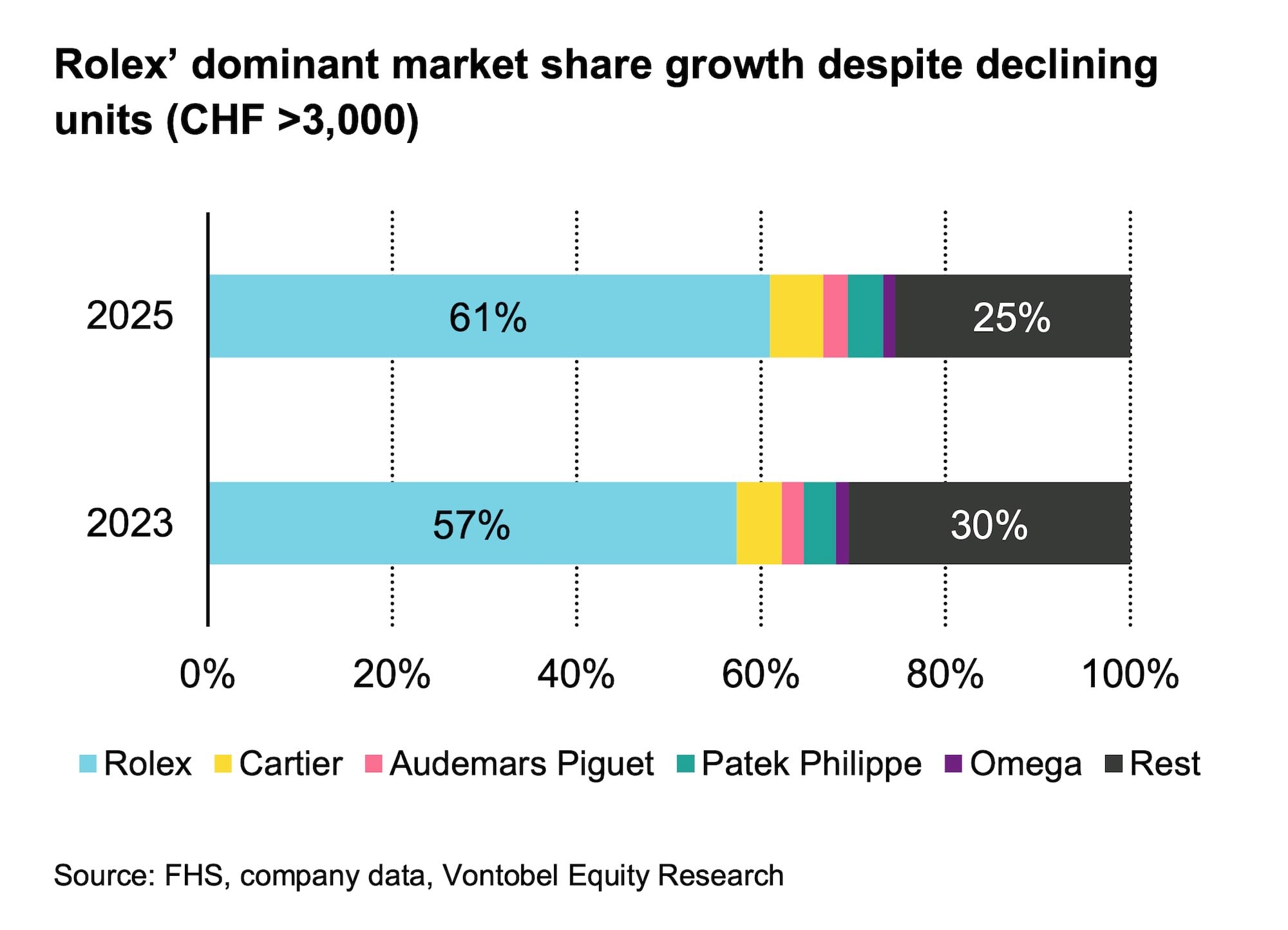

Reproduced with permission from Vontobel

Reproduced with permission from Vontobel

But the situation is twofold. While the big brands report higher results, this growth masks a decline in volumes in the traditional core segment of Swiss-made luxury watches (export price above 3,000 CHF). Vontobel explains: “In the last two years, the segment above CHF 3,000 has exported around 220,000 fewer watches, a decrease of just over 10%, which confirms that even the upper price segment is not immune to volume pressure.” But that's only one side of the coin, because Vontobel now estimates that “watches priced above 20,000 CHF have increased significantly in the same period, by almost 50,000 additional pieces. This means that the “core” high-end segment between 3,000 and 20,000 CHF has shrunk even more.” This reinforces the idea that ultra-luxury is taking up a growing share of the industry, while the core range of Swiss watches is suffering from a volume crunch.

Last but not least, Vontobel points out that Rolex has cut production in 2025 for the second year in a row, although “most likely on purpose, as the brand prioritizes scarcity and pricing power over incremental unit growth.”

To find out more about the development of the luxury watch industry, we will be interviewing Jean-Philippe Bertschy, Head of Swiss Equity Research at Vontobel, in the coming days. We are also waiting for the LuxeConsult/Morgan Stanley reports to be published.

https://monochrome-watches.com/industry-news-top-10-largest-watch-brands-in-2025-rolex-still-the-undisputed-king-despite-trimmed-produktion-lower-exports/